Matt Taibbi introduces Paul Ryan

What does Matt Taibbi think of Paul Ryan?

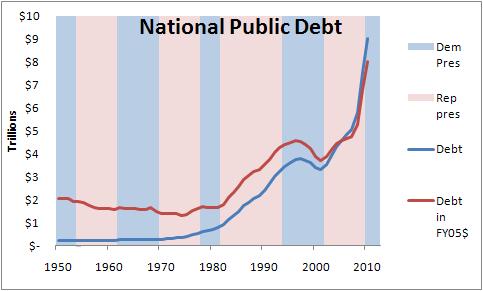

Paul Ryan, the Republican Party’s latest entrant in the seemingly endless series of young, prickish, over-coiffed, anal-retentive deficit Robespierres they’ve sent to the political center stage in the last decade or so, has come out with his new budget plan. All of these smug little jerks look alike to me – from Ralph Reed to Eric Cantor to Jeb Hensarling to Rand Paul and now to Ryan, they all look like overgrown kids who got nipple-twisted in the halls in high school, worked as Applebee’s shift managers in college, and are now taking revenge on the world as grownups by defunding hospice care and student loans and Sesame Street. They all look like they sleep with their ties on, and keep their feet in dress socks when doing their bi-monthly duty with their wives.What about Ryan's "bold" plan to balance the budget? Well, it's not entirely about cutting costs. It's also about drastically cutting income: It "includes dropping the top tax rate for rich people from 35 percent to 25 percent. All by itself, that one change means that the government would be collecting over $4 trillion less over the next ten years." Ryan's budget is thus a method of forcing middle class folks to give up valuable benefits so that rich folks can pay less tax. Bill Maher isn't pleased about Ryan's suggestion that he is offering a "cause" rather than a "budget."

No, it’s not a cause, it is a budget, that’s how we should look at it and it’s how we should solve these things. But the problem is that we don’t have one party that stands up to the other side, we have two parties who are agreeing that we should cut from the EPA and people who do the inspections of food and Pell grants and home heating oil for the poor, and nobody is standing up and saying, “No, we should take it from the defense department, from foreign subsidies, from tax cuts for the rich, for corporations like GE that paid no taxes last year.” That’s what’s wrong with our political system.And one more thing. This cartoon seems to capture another major aspect of the GOP mindset when it comes to balancing the federal budget.