Glenn Greenwald's comments regarding the vague terms that control our public policy provoked me to revisit the extremely vague term, "free market." “Free market” is a prime example of a vague term that is used for formulating anti-public policy.

It is routinely suggested by our alleged leaders that “free market” refers to the freedom to choose where to spend one’s money. On a day to day basis, this idea seems reasonable. It evokes the image of people selecting fruits and vegetables at an open-air produce market.

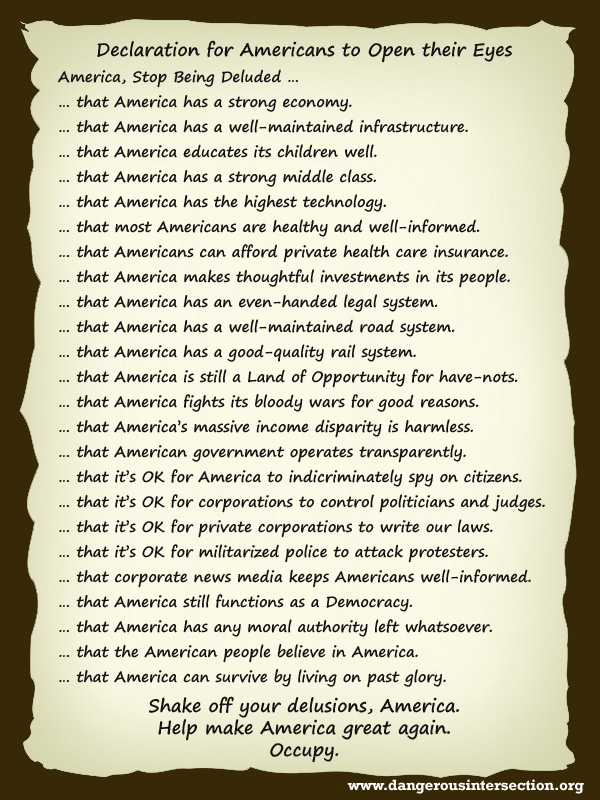

Modern "free market” policies extend far beyond individual buying decisions, however. In practice, government policies favoring the “free market” prohibit government from “freely” governing. “Free market” policies allow those with large amounts of money to usurp government policy. Policies that favor a wide-open "free market" take political power from ordinary citizens and hand that power to govern to large private for-profit corporations and wealthy individuals. “Free market” is a clever phrase for those who want an economic market that amounts to a baseball game without umpires, a market where corporations “freely” monopolize entire industries by scooping up the competitors, immunizing themselves from liability by buying favorable new laws, jacking up the prices and then giving the consumers the “freedom” to buy from among limited high-priced options. Modern "free market" policies give financially powerful entities the "freedom" to operate free of any government oversight, and the "freedom" to tell consumers to take-it-or-leave-it.

[More . . . ]