Tim Geithner, appointed to Secretary of the Treasury despite being unable to calculate his own taxes, has just proven he does not understand the role of oil prices in modern economies. Speaking at a breakfast today in Washington, Geithner claimed that:

“The economy is in a much stronger position to handle” rising oil prices, Geithner said…. “Central banks have a lot of experience in managing these things.”

This is the opposite of truth. Central banks do not, in fact, have a lot of experience in dealing with rapidly rising oil prices in a worldwide recessionary environment where there is no clear deflation nor inflation. Hell, central banks do not even have a lot of experience in managing an out of control real-estate bubble, or dot-com bubble, or any of the economic crises that hit over the past decade or so. Nor is the American economy in a “much stronger” position than it was in 2008, which was the last time a major oil price spike played a role in devastating the world economy.

In fact, there is no shortage of people arguing the opposite of Geithner. Let’s start with Fatih Birol, the chief economist of the International Energy Agency (IEA). Just yesterday, he warned of the danger of high oil price’s impact on the economy:

Fatih Birol, the IEA’s chief economist, said high prices could put pressure on central banks to raise interest rates, especially in more developed countries such as the UK. “Oil prices are a serious risk for the global economic recovery,” he said. “The global economic recovery is very fragile – especially in OECD countries.” He said oil prices had entered a “danger zone” for the recovery at over $90 a barrel.

Economic analysts for the major banking institions agree with Birol.

While few analysts see oil returning to its high of $147 hit in 2008 because of oil producers’ excess capacity, crude prices do represent a threat to the global economy and particularly to Europe at levels even well below that.

“Whenever the size of the energy sector in the global economy reached 9 percent, we went into a major crisis,” said Sabine Schels, a commodity analyst at Merrill Lynch.

“It was in the 1980s and it was the same in 2008. Right now we are at about 7.8 percent and if you go above $100 per barrel to $120 per barrel, you get to that 9 percent level.”

Other analysts have calculated exactly how much impact rising oil prices have on the economy:

No one knows precisely at what point oil begins to substantially hinder consumer spending and slow commercial activity — but this much is known: every $1 per barrel rise in oil decreases U.S. GDP by $100 billion per year and every 1 cent increase in gasoline decreases U.S. consumer disposable income by about $600 million per year.

To be sure, the flexible and resilient U.S. economy is more-energy efficient today that it was in 2008, and will likely become even more efficient in the years ahead, but that doesn’t blot-out the fact that the United States remains an oil-dependent economy. Most cars still run on gasoline, trucks on diesel, and oil is also a major fuel for heat. Hence, sustained, high oil prices translate in to bag things for U.S. GDP, corporate earnings growth, and by extension, for most U.S. stocks.

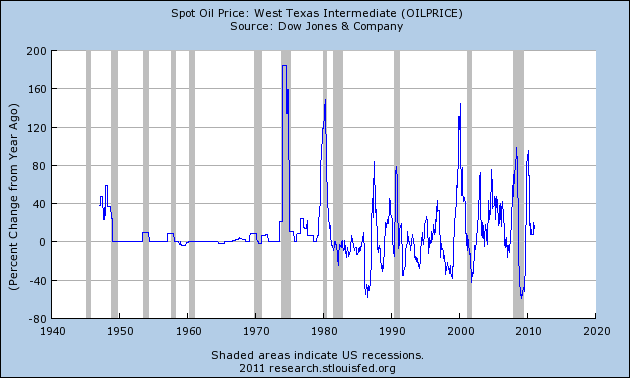

Even data from the Federal Reserve tends to support the conclusion that oil prices are intimately tied up with the economy. See this chart from the St. Louis Fed, showing that with only one exception, oil price rises of over 80% year-over-year have been followed by recession for the last 40 years. I don’t count the 2010 oil price spike as an exception as I fully expect a renewed recession as a result of these oil prices:

In racking my brain trying to understand how Geithner could make such a boneheaded claim, it suddenly hit me. He meant that higher oil prices won’t have a material impact on the wealthy. Proportionally speaking, that’s true, but only at the first derivative. Gail at The Oil Drum explains:

Energy expenditures are not a big share of income for high income people, but they are for the many people getting along on minimum wage, or close to minimum wage. If oil prices go up, these folks find the price of food and gasoline going up, and perhaps the price of home heating and electricity (because the prices of the various types of energy tend to move together). They find their budgets stretched, and they either

1. Cut back on discretionary spending, or

2. Default on loan repayments.

A similar situation happens to the many people who earn more than minimum wage, but live paycheck to paycheck, and pretty much spend all the money they earn. As the prices of energy-related goods rise, these people too find a need to cutback. Some will cut back on discretionary goods; others will default on loan repayments; some will do both.

Thus, when oil prices rise (or energy prices in general rise), we end up with two main effects:

1. Banks find themselves in worse condition because of many loan defaults.

2. The economy starts feeling recessionary impact, because so many people cut back on buying discretionary goods.

And bingo, the recessionary cycle starts again. Geithner’s worldview is so far gone from that of most people, though, that he doesn’t understand microeconomics. A rise of a dollar in the price of gas will not force hard personal choices on Geithner, nor I daresay many of his pals. But for the vast majority of Americans, we live on an actual budget. A rising gas price means that we can’t spend that money on other things. Simple, right? Too bad they guy in charge of the Treasury doesn’t understand it.

Economist Simon Johnson explains that Geithner also doesn't understand why Too Big to Fail is a problem.

Brynn: I wish I could disagree with anything you've written in this detailed article.

I would offer this admittedly simplistic hypothetical:

What if tomorrow's paper announced that the U.S. discovered an immense amount of cheaply extracted oil in Montana. Imagine that the new oil fields would show that the U.S. now had twice as much oil as Saudi Arabia. Can you imagine the glee of politicians? They would be glad-handing each other, talking about the virtues of cheap oil. They would say that this is GREAT for America and for America's economy. They would talk about energy independence, because we no longer need to import oil. They would brag that this would allow Americans to maintain the lifestyle to which we are accustomed.

Too bad we didn't recently discover such an immense source of oil. In fact, we are looking at oil that is shooting up in price, and it's being imported. Shouldn't this mean the opposite of everything in my hypothetical? I think so.

If lots of cheap domestic oil is good for the economy, then dwindling supplies of expensive imported oil is bad for our economy–terrible for our economy. Regardless of what Tim Geithner proclaims. Geithner had zero credibility coming into the current crisis. He hasn't said anything at all to change my opinion of him.

Erich-

I love your thought experiments for just this reason. Absolutely, great point. If energy independence & cheap oil are great for the U.S. economy, obviously the inverse is true as well. More and more, I believe that Geithner, Bernanke, etc… believe that their role is more of a "cheerleader" than that of providing technical expertise. They seem to believe that if they can convince enough people that the economy is strong and growth is right around the corner, the problems will work themselves out somehow. To me, it looks more like an ostrich with its head in the sand.

Bloomberg headline today: "U.S. stocks retreat on concern oil rally will harm economy". I guess they didn't get Geithner's memo.

Did you choose Montana at random, or did you hear about this?

http://www.grandforksherald.com/event/article/id/…

http://en.wikipedia.org/wiki/Bakken_Formation

I haven't tried to look up any USGS info, so I'm posting the links without qualification (the AP article smacks of too good to be true). Maybe somebody will volunteer to drill deep (argh) and validate/refudiate what's been reported.

Jim: I picked Montana at random. I didn't realize that there was much oil to be had in those parts of the country.

Jim-

The Bakken formation holds an estimated recoverable amount of oil of 3.65 billion barrels, according to the mean estimate in the Wikipedia article to which you link. At current US consumption rates of 21 million barrels per day, that's approximately 174 days of supply– hardly enough to make us energy independent.

Additionally, recovering the bulk of that oil requires "fracking", the controversial and environmentally devastating practice which is profiled in the new documentary "Gasland".

Even the Wall St. Journal jumped on board yesterday in their article entitled "Rising oil prices raise the specter of a double-dip" [recession]:

Thanks, Brynn. I covered some of this in grad school in 1999-2000, so am comfortable digesting the source data, but I have other things tugging at me now. Besides, I knew "someone" (had a feeling it would be you) would run the info to the ground.

Jim-

Call me compulsive if you want. 🙂 I'll call it passionate.

Every few years, some new oil field or technique is in the news, promising salvation from our energy woes. Two decades ago, it was the North Sea (now peaked and in serious decline). A decade ago it was Cantarell, in Mexico (now peaked and in serious decline). Lately it's been deep-sea Brazilian waters, the Bakken formation, or some other such field with wild claims for future energy production which never seem to pan out. Some people still hold out hope for Alaskan oil, even though estimates of reserves there were lowered by some 90%</a rel="nofollow"> last year.

As you note, the news tends to tilt these stories to the "too good to be true" side, and use the damndest of all lies, statistics, to convey a misleading message. For example, the AP article in your link claims that the "vast" Bakken field is expected to produce 1 mbpd (million barrels per day), but may yield up to 2 mbpd. The glowing phrases that accompany this tell us that this is "more than the entire Gulf of Mexico produces now", and that it could "help reduce oil imports by more than half". To most people, that sounds like "Hooray, our problems are solved!". But it's still only 1-2 mbpd, on domestic consumption that fluctuates between 18-21 mbpd in the U.S., so it's really not that great. But the news stories rarely put those sorts of things into context. Only at the bottom of the article does the author place these findings into a bit of context:

Of course, the author leaves the article on a high-note, in the most non-specific way:

So that's Peak oil: once individual fields peak, they go into irreversible decline, sometimes very rapidly depending on the management of the field. Data from individual fields can be extrapolated to countries, and from there to the world. The U.S. was predicted to hit peak oil in the 1970's, and so they did. All the new finds since then have tempered the rate of decline, and even allowed us to increase production year-over-year, but nowhere near where production was when it peaked.

But this style of dishonest reporting does not do justice to the truth of the matter. Most people take away from it that there is no problem, we can continue to consume exactly as we have been and the oil will always be there, and at low prices. Something's gotta give.

"In a recent interview, United States Treasury Secretary Tim Geithner laid out his view of the nature of world economic growth and the role of the US financial sector. It is a deeply disturbing vision, one that amounts to a huge, uninformed gamble with the future of the American economy – and that suggests that Geithner remains the senior public official worldwide who is most in thrall to the self-serving ideology of big banks."

Simon Johnson, http://www.project-syndicate.org/commentary/johns…

Secretary of Energy Steven Chu gets it. "Today's spike in oil prices is causing great concern, great hardship [for] the American people," he said while testifying before the US Congress. "We have a very delicate recovery going on and an increase in prices will make that vulnerable."

I'm amazed at our leadership. It is obvious that our entire well-being is contingent on the availability of cheap oil. Yet we have no control over the cheapness of oil anymore and in fact, all indication is that oil will be far more expensive in five and ten years than it is now. We know it's critical, we know hard times are here and yet what are we doing to wean ourselves off the oil? The Republicans disparage conservation, which could get us some immediate relief. The Democrats voice concern and do next to nothing.

It's almost treasonous.