A few weeks ago, I wrote a post entitled “The Unspoken Reality of ‘Peak Oil’“, in which I tried to convey the scale of the problem we face. “My main motto never changes, the era of low oil prices is over,” said Dr. Fatih Birol who is the Chief Economist for the International Energy Agency (IEA). Now we have even more confirmation that peak oil has arrived. Today, the IEA released their 2009 version of the annual World Energy Outlook, in which they attempt to forecast supply and demand through 2030. And once again, the IEA continues to forecast that there will be plenty of supply, if only we can muster the needed capital investments. Unfortunately, the needed capital investments are enormous:

The capital required to meet projected energy demand through to 2030 in the Reference Scenario is huge, amounting in cumulative terms to $26 trillion (in year-2008 dollars) — equal to $1.1 trillion (or 1.4% of global gross domestic product [GDP]) per year on average. (p.43)

As if that weren’t bad enough, the release of the report has been almost completely overshadowed by yesterday’s Guardian which has alarming allegations from two different whistleblowers within the IEA:

The world is much closer to running out of oil than official estimates admit, according to a whistleblower at the International Energy Agency who claims it has been deliberately underplaying a looming shortage for fear of triggering panic buying.

The senior official claims the US has played an influential role in encouraging the watchdog to underplay the rate of decline from existing oil fields while overplaying the chances of finding new reserves.

The second whistleblower had much the same to say:

A second senior IEA source, who has now left but was also unwilling to give his name, said a key rule at the organisation was that it was “imperative not to anger the Americans” but the fact was that there was not as much oil in the world as had been admitted. “We have [already] entered the ‘peak oil’ zone. I think that the situation is really bad,” he added.

These new allegations only bolster the case of peak oil theorists, who insist that reserves have been overstated for years. Nearly everyone has an incentive to overstate

the reserves: oil companies’ stock performance is closely linked to their reserves, OPEC nations’ production levels are constrained to a function of their reserves (as stated reserves increase, they are allowed to sell more oil), and Wall Street prefers a steady rise in the price of oil to panic-buying followed by a collapse. It’s also worth noting that this is not the first time that doubt has been cast on IEA figures:

The International Energy Administration is, supposedly, the gold standard for projections of future oil supply. In 2004 they projected that the world would produce 121 million barrels per day of crude oil [by 2030]. In 2005 they lowered that to 115 million bpd. Last year they lowered it again to 106 million bpd.

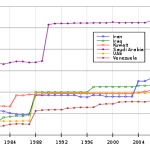

The latest forecast has lowered it (again) to 105 million bpd, ostensibly due to decreased capital investment as a result of the credit and financial crisis of the last few years. Even their data indicates a production plateau can be maintained only through fields yet to be found or developed (see graph). See also this article about ExxonMobil’s overly rosy production forecasts over the last decade or so.

Tangentially related, consider the case of the big oil-producing companies. Assuming peak oil is a real threat of which they were aware years ago, what would one expect them to do? Initially, one would expect them to increase budgets for exploration. They would probably also begin to cannibalize the existing resource base through mergers and aquisitions. If those attempts still fail to bring in sufficient supplies, one might expect them to begin to downsize and shift resources away from exploration as the inevitable constraints of production set in. In fact, that is exactly the model we see being played out. B-net has a summary of the capital-expenditure plans of the big oil companies and apart from the very few at the top, most of them are slashing exploration budgets. Even Conoco-Phillips, the nation’s third-largest oil company, recently announced plans to “shrink to grow”:

ConocoPhillips CEO James Mulva signaled a dramatic shift in course for the nation’s third-largest oil company Wednesday, saying that after years of bulking up through acquisitions, it is now focused on being a smaller, leaner business that takes better care of its shareholders.

“Some will say what we’re doing essentially is that we’re shrinking to grow,” Mulva said during a conference call to discuss the company’s quarterly earnings. “That would be a fair assessment.”

But the change is necessary in light of the global recession and the difficulty of accessing new oil and gas reserves around the globe, coupled with the massive costs of extracting them, he said.

Colin Campbell, a leading peak oil theorist and former oil executive at Total, predicted much the same in 2004:

Campbell: The majors are merging and downsizing and outsourcing and not investing in new refineries because they know full well that production is set to decline and that the exploration opportunities are getting less and less. Who would drill in 10,000 feet of water if there were anywhere else easier left? But the companies have to sing to the stock market, and merger hides the collapse of the weaker brethren. The staff is purged on merger and the combined budget ends up much less than the sum of the previous components. Besides, a lot of the executives and bankers make a lot of money from the merger.

Taken together, these facts continue to vindicate the peak-oil theorists at the expense of those who insist that the world has plenty of oil.

Guy McPherson, Professor Emeritus of Natural Resources and Ecology & Evolutionary Biology at the University of Arizona weighed in on the IEA reports:

Brynn: Are you trying to start a panic? More seriously, I have followed this issue closely for several years, and the information you have provided is terrifying. I hadn't really thought much about all the motives for cover-up.

The topic of peak oil should be dealt with openly and regularly on the front pages of newspapers. As it turns out, we have 10 times the coverage of "drill baby drill," without any meaningful counterpoint.

We are a country of citizens that are deeply in denial. We are a country currently run by powerful corporate forces that appear to be manipulating the numbers regarding oil reserves much the same way that Wall Street was manipulating bond ratings. This is terrible news.

May we somehow have a soft landing if and when we someday get up the courage to hear what we will find to be abysmal news . . .

Erich-

At this point, I could understand panic. What I'm having a hard time understanding is the utter indifference and denial.

Amen

Richard Heinberg of the Post Carbon Institute:

On one hand, careers are at stake if IEA officials step forward and tell us the truth. On the other hand, the global economy is as risk if they don’t. There is evidently a quiet battle raging within the agency, and within the consciences of many of its officials. So far, we are all the losers in that battle.

http://www.postcarbon.org/blog-post/44016-just-te…