I live in an odd city. Back in 1876 the City of Saint Louis seceded from its otherwise rural county. Saint Louis was a major transportation hub (rail) and industrial center. The rural county was seen as sucking on this rich teat to enrich the farmers. So the city decided to shed its poor panhandling neighbors for its own greater glory. Then came the automobile, industrialized farming, suburbs, and ex-urbanization. Oops. By the mid 2oth century, the city had to enact an earnings tax to help cover the shortfall in revenue.

At the end of the first decade of the 21st century, the Tea Party movement managed to put an odd law up for vote in Missouri. Thus the rural majority voted to forbid cities to have the ability to assess any new earnings taxes, ever. And furthermore to require a public vote every few years on whether the people would like to continue paying for the services they receive in this way in cities that already have such taxes.

“Plunk,” goes the bond rating in the only two cities for which this clause applies, Saint Louis and Kansas City. But we dutifully held that vote this week, only five months since that new law passed.Proposition E reads:

“Shall the earnings tax of 1%, imposed by the City of St. Louis, be continued for a period of five (5) years commencing January 1 immediately following the date of this election?”

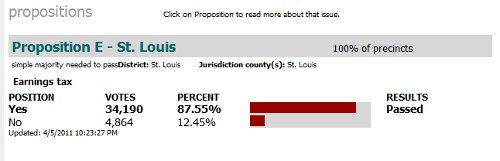

How did we do?

Passed by 7 to 1. Yay! We get to keep paying 1% of our income to support city services.

Passed by 7 to 1. Yay! We get to keep paying 1% of our income to support city services.

I live in semi-rural Jefferson City, and I was dismayed to see that Tea Party-endorsed measure of which you speak. I am proud that St. Louis stared the Tea Partiers down and passed the tax initiative they needed to keep things running. Too bad the Missouri and federal legislatures lack the backbone to do the same for state/federal funding.

I voted and I proudly pay my 1%. I guarantee that the "free market" wouldn't provide the many services that city government does.

Notice that there were about 39,000 total votes on the issue out of a population of 357,000? That's an 11% turnout. That's not too bad for an election in which most offices were uncontested, and only one proposition.

(U.S. Census Bureau Saint Louis, MO stats)

Erich,

Congratulations on willfully paying your taxes, but I am left wondering why you felt the need to put "free market" in quotes the way you did. Was it an attempt to state that you don't think the free market exists, and thus need to quote it like "easter bunny"? Or was it referential implication, that reader is supposed to understand that it comes from a specific source? If the latter, which source? Adam Smith? JS Mill? Forbes Magazine? Mad Magazine?

I'll guess that your comment was aimed at stating your belief that sometimes taxes are necessary, and that there are civil services provided by a city/county/state/federal government that simply cannot be handled by a 'free market'. As the closest thing to a Libertarian as this blog gets, I'll take this opportunity to respond:

1. There are the wacko elements of libertarians who read Ayn Rand with a straight face and actually think that all things can be determined through contracts and private markets, including every road you drive and every drop of water you drink. These are the same ones that hoard gold and honestly think that we should start issuing silver certificates instead of printing $20 Jacksons. I'm not one of them. Most people are not them. Just as any political movement, there are radical fringes that tend to set the initial vibes and stronger drumbeats in an argument, but those arguments hold little water over distance.

2. There are many people with libertarian leanings that do believe in a free market, or at least the concept of one as a ruler or guideline against which regulation and government oversight can be judged. NOTE: these people believe there should be a government, and that government should operate within some guidelines. The ideal of a free market is one of those guidelines, just as "equality before the law" and "created equal" are idealized guidelines but rarely actually true.

3. In the immediate sense of taxes, "free market libertarians" (my term) often take a critical look at services delivered by a government, and actively question which ones could be peeled off and handed to a competitive environment. Other services simply function better and –this is the important part– are actually cheaper if handled by the government. I would put fire, police, roads, water, sewer in this categories. I'm not sure I would put the post, garbage collection, or health care in this category: private vendors exist, and often do a better job at it than a government.

4. While not a resident of St Louis, I am against the 1% income tax– not because I think the city can just hand things over to some market that would swell up out of Soulard's cobblestone streets overnight, but because the method of taxation is ineffective, regressive, and harms the business potential of the city. In short, it's a bad deal for the city and harms competitiveness.

I would propose that property taxes are a much better method of getting the funds to power the city, because property is the actual thing of value that a city is trying to protect/enhance by providing all of those services. Yes, yes– humans are valuable, but their income is actually quite flexible and varied, and hits people on a much more personal level. If the city were to change its focus on increasing the value of property, many subsequent policies and approaches would change, almost all for the better: poor neighborhoods would bring in no tax revenue for the city, and thus the city would be forced to do something to increase the value. Rich neighborhoods would bring in quite a bit of revenue, and they would continue to get the services they demand (pushing overall demand). Renters would pay no taxes, their landlords would.

As for the "free market", I would hope that the city could take a very critical eye at seeing which services it might peel away, or at the very least re-integrate back in with the county for overall efficiencies (fire protection and transportation come to mind right away).