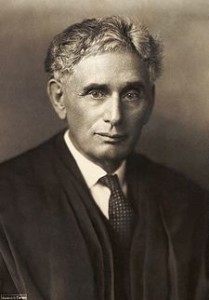

“We can have democracy in this country, or we can have great wealth concentrated in the hands of a few, but we can’t have both.” –Supreme Court Justice Lous D. Brandeis

For all the discussion of “green shoots” and an economy on the mend, there’s plenty of data and commentary to the contrary. What’s interesting to me, is that recent developments only highlight the extent to which Main Street economics have become irrelevant to Wall Street.

The administration is claiming that the crisis is largely over, and that it’s time to breathe a sigh of relief. President Obama yesterday argued that “we can be confident that the storms of the past two years are beginning to break.” Treasury Secretary Timothy Geithner discussed last week beginning to wind down some of the programs that were implemented in the heat of the crisis late last year. The value of the Dow Jones Industrial Average has risen from its July low of 8146, and is now trading around 9600. Everything seems well and good in the world of high-finance.

But others see it differently. Nobel-prize winning economist Joseph Stiglitz argued this week that nothing has been done to address the underlying banking problems that created the mess in the first place, adding that “the problems are worse than they were in 2007 before the crisis.” Simon Johnson, former chief economist of the IMF, echoes that sentiment, and points out that the real issues underlying the crisis have not been addressed at all. He lays out 4 areas of concern:

- The big banks need to be made to be dramatically smaller.

- Executives need to have a great deal of their personal wealth tied up in their banks to prevent a reckless focus on short-term results.

- An end to the revolving door between Wall Street and Washington, DC. “There is no way people should be able to go directly (or even overnight) from a failing bank to designing bailout packages to benefit such banks. In any other industry, in any other country, and at any other time in American history, this would have been seen as an unconscionable conflict of interest. “

- The financial elite is aware that they are able to exploit the Federal Reserve and use it as a “bailout machine”.

Johnson has an amazing ability to simplify complex financial and economic concepts in ways that make them understandable to most, and I highly recommend his blog as a way to keep tabs on what’s happening. He also has the uncommon temerity to insist that the United States ought to apply the same economic medicine to itself that it prescribes to the rest of the world (i.e. liquidate debt, not transfer it to the government; allow failing enterprises to fail).

Even analysts for the major banks worry that the economy isn’t on sound footing. Morgan Stanley economist Stephen Roach argues today that “The economy is growing very close to what people refer to as a stall speed. It lacks a cushion should there be something unexpected. When those shocks come, you don’t have the cushion and you’re vulnerable, you could have a relapse. Any recovery from a relapse will also be anemic.”

Meanwhile, nothing has been done to assist Main Street. Foreclosures filings have been humming along at at least 300,000 per month for the last 6 months, and approximately one in 25 American houses are in foreclosure. 7 million people have become unemployed since the start of the recession, and the unemployment rate is at a 26-year high of 9.7%. Main Street businesses continue to shutter their doors, and anecdotal evidence from around the country points to continuing problems.

But I didn’t start this post out with the intent of writing a dull post on economics. What I’ve noticed over the last week is the unbelievable sense of entitlement, selfishness, power, and greed that have become characteristic of Wall Street. Actually, it’s been on display for much longer than the last week, but a few items I’ve noticed lately have really brought that home.

President Obama spoke yesterday on the anniversary of the collapse of Lehman Brothers. The topic of his speech was the financial regulations that he’s proposing as a means of reining in the power of these financial institutions. Check out this excerpt from his speech:

At the same time, what we must do now goes beyond just these reforms. For what took place one year ago was not merely a failure of regulation or legislation; it was not merely a failure of oversight or foresight. It was a failure of responsibility that allowed Washington to become a place where problems — including structural problems in our financial system — were ignored rather than solved. It was a failure of responsibility that led homebuyers and derivative traders alike to take reckless risks they couldn’t afford. It was a collective failure of responsibility in Washington, on Wall Street, and across America that led to the near-collapse of our financial system one year ago.

Restoring a willingness to take responsibility — even when it is hard — is at the heart of what we must do. Here on Wall Street, you have a responsibility. The reforms I’ve laid out will pass and these changes will become law. But one of the most important ways to rebuild the system stronger than before is to rebuild trust stronger than before — and you do not have to wait for a new law to do that. You don’t have to wait to use plain language in your dealings with consumers. You don’t have to wait to put the 2009 bonuses of your senior executives up for a shareholder vote. You don’t have to wait for a law to overhaul your pay system so that folks are rewarded for long-term performance instead of short-term gains.

The fact is, many of the firms that are now returning to prosperity owe a debt to the American people. Though they were not the cause of the crisis, American taxpayers through their government took extraordinary action to stabilize the financial industry. They shouldered the burden of the bailout and they are still bearing the burden of the fallout — in lost jobs, lost homes and lost opportunities. It is neither right nor responsible after you’ve recovered with the help of your government to shirk your obligation to the goal of wider recovery, a more stable system, and a more broadly shared prosperity.

So I want to urge you to demonstrate that you take this obligation to heart. To put greater effort into helping families who need their mortgages modified under my administration’s homeownership plan. To help small business owners who desperately need loans and who are bearing the brunt of the decline in available credit. To help communities that would benefit from the financing you could provide, or the community development institutions you could support. To come up with creative approaches to improve financial education and to bring banking to those who live and work entirely outside the banking system. And, of course, to embrace serious financial reform, not fight it.

Notice anything? Apparently homeowners and mega-banks are equally to blame for the crisis. Nevermind that so many of those homeowners were duped into loans that they didn’t understand or couldn’t afford. Beyond this mis-characterization of the causes of the crisis though, notice how Obama asks Wall Street to please start doing the right thing. “Please, Mr. Banker, use plain language in your dealings with customers, and please overhaul your pay system and please lend more, if you would. Oh, and please don’t fight my proposed financial reforms.”

But I wonder who he was talking to, since not a single CEO of a major bank was in attendance. Allow me to repeat that, because it’s important. Not one single, solitary CEO from a top U.S. Bank was in attendance for the President’s speech where he lays out his proposed overhaul for the financial system. Despite trillions of dollars in bailouts and guarantees, apparently these banksters can’t be troubled to attend his speech to find out what he’s proposing to do. As Simon Johnson said, “How’s that for demonstrating respect, gratitude, and a willingness to behave better?” How arrogant can they be?

There is an alternate explanation, though. Perhaps they needn’t have worried what he was proposing, because they knew it would be friendly to their interests. Obama told these CEO’s back in April that “My administration is the only thing between you and the pitchforks.” That quotation came from Politico, which has a well-known slant to the right, and the story makes it sound as though this was a hard-nosed meeting where Obama laid down the law with the CEOs. Economist Dean Baker interprets it differently, saying “It serves both the bankers and President Obama to have President Obama seen as being tough on the banks, even as he hands them this money. Maybe he really only did give the bankers one glass of water and maybe he really did speak sharply to them. But, the bank chieftains were probably happier with this reception than they would have been with a gourmet lunch and music that didn’t come with the $1 trillion.”

Also in April, Senator Dick Durbin (D-Ill) said that “And the banks — hard to believe in a time when we’re facing a banking crisis that many of the banks created — are still the most powerful lobby on Capitol Hill. And they frankly own the place.” Unfortunately, that’s not hyperbole– perhaps they feel that they own D.C. because of the amount of money they’ve spent on campaign contributions. OpenSecrets.org reports that Congressional supporters of last year’s wildly unpopular bailout received 51% more campaign contributions from the finance sector than those who opposed the bailout. OpenSecrets also maintains a list of worst offenders in the “revolving door” between lobbyists and government. It includes names like Citigroup, Freddie Mac, and the American Bankers Association. Top contributors to Obama’s presidential campaign include Goldman Sachs, Citigroup, JPMorgan Chase, UBS AG, and Morgan Stanley. As a whole, the Securities and Investment industry donated $14,808,875 to his campaign, the “Misc. Finance” industry donated $6,390,199, and Commercial Banks were good for another $3,244,103. Earlier, the Obama administration proved their kinship with Wall Street by helping the banks defeat or avoid restrictions on pay and bonuses that were legislated following news of massive payouts to the very people who were culpable for the crisis and who had received billions in taxpayer aid.

And yet, even this does not satisfy Wall Street. In the same article quoted above, Morgan Stanley economist Stephen Roach has the following quotation:

With all due respect to the president, who I voted for, I don’t think he’s really described the culture of a Wall Street that I know and that I’ve worked in for 30 years. Certainly there are problems that have been evident on Wall Street in this last 10 years, and we should accept our responsibility for them.

“Washington played an equally significant part in failing to oversee the financial system from the standpoint of its regulatory standpoint as well as from its monetary policy by the central bank. We’re all in this together, and the president should be held at his word of shared responsibility for the crisis.”

I guess that fits in with the President’s rhetoric that everyone’s at fault, but it still seems strange to argue that Wall Street’s greedy and reckless banks are not to blame–rather it’s the fault of Washington for failing to stop them from being so greedy and reckless?

Speaking on the failure to solve the fundamental problems, Joseph Stiglitz is quoted by Bloomberg “It’s an outrage,” especially “in the U.S. where we poured so much money into the banks. The administration seems very reluctant to do what is necessary. Yes they’ll do something, the question is: Will they do as much as required?” Simon Johnson agrees, calling the new capital requirements proposed by Obama “dinky” and saying that “the last time our financial system showed this taste for risk and a comparable level of incompetence (prior to 1935), it had equity relative to assets roughly three times current levels… There is no proposal on the table, either in the US or within the G20, that is even remotely in the right ballpark. President Obama has put his finger on the problem but is apparently unwilling to do anything about it.”

In the coming days, I will highlight more about how the current economic problems are affecting real people, but I wanted to point out one last thing that Simon Johnson brought up. His post that I’ve been quoting from is entitled “Obama and Brandeis”, aptly referencing Louis Brandeis, the populist Supreme Court justice from 1916 to 1939. Brandeis is the author of the famous quotation that “sunlight is said to be the best of disinfectants”, but he was also an early opponent of the concept of “too big to fail”:

“A large part of our people have also learned that efficiency in business does not grow indefinitely with the size of business. Very often, a business grows in efficiency as it grows from a small business to a large business; but there is a unit of greatest efficiency in every business, at any time, and a business may be too large to be efficient, as well as too small. Our people have also learned to understand the true reason for a large part of those huge profits which have made certain trusts conspicuous. They have learned that these profits are not due in the main to efficiency, but are due to the control of the market, to the exercise by a small body of men of the sovereign taxing power.”

Johnson’s blog post ends:

Brandeis was scathing about the individuals behind the financial structures. For him, it was about power and it was about control. He was appalled by how big finance operated and he worked hard – an uphill slog – to rein it in.

But Brandeis never saw anything like what we have now experienced, with regard to the amount of taxpayer money that the banks are able to expropriate when downside risks materialize. The big banks that Brandeis feared did not, in the end, dominate the 20th century. But they are back now, with unfettered power and an arrogance that spells trouble.

Ultimately, we will put the banks back in their regulatory box or they will bankrupt us all.

Bravo! Excellent recap, and I share your concerns. I am especially concerned that Obama has insufficient power and motivation to make the financial system transparent and accountable. I'm convinced that Durbin is spot on when he states that the banks are running Congress.

Speaking of sunshine as a disinfectant, does Tim Geithner inspire your confidence when he repeatedly argues that the Federal Reserve should not be subject to a public audit? Tim Less-Public-Information-Is-Better Geithner was pressed repeatedly in this interview. After watching, I was convinced that Geithner does not see his client to be the citizens of the United States. Rather, he is deeply conflicted by his close ties to Goldman Sachs and other Wall Street entities.

<object id="wsj_fp" width="512" height="363"><param name="movie" value="http://s.wsj.net/media/swf/main.swf"></param><param name="allowFullScreen" value="true"></param><param name="allowscriptaccess" value="always"></param><param name="flashvars" value="videoGUID=A0A13568-043B-468A-A8A9-0D5426057FEF&playerid=1000&plyMediaEnabled=1&configURL =http://wsj.vo.llnwd.net/o28/players/&autoStart=false" base="rtmpt://wsj.fcod.llnwd.net/a1318/o28/video"name="main"></param><embed src="http://s.wsj.net/media/swf/main.swf" bgcolor="#FFFFFF"flashVars="videoGUID=A0A13568-043B-468A-A8A9-0D5426057FEF&playerid=1000&plyMediaEnabled=1&configURL =http://wsj.vo.llnwd.net/o28/players/&autoStart=false" base="rtmpt://wsj.fcod.llnwd.net/a1318/o28/video" name="main" width="512" height="363" seamlesstabbing="false" type="application/x-shockwave-flash" swLiveConnect="true" pluginspage="http://www.macromedia.com/shockwave/download/index.cgi?P1_Prod_Version=ShockwaveFlash"></embed></object>

Erich-

I watched this whole Digg Dialogue when it first came out, and was immediately struck by it. Geithner seems like a guy who has been coached to seem empathetic– he keeps repeating that people's concerns are "totally understandable", and then dissembles on the real answers. Also, if you start watching around the 7 minute mark, you can see him actually laugh when answering a question as to whether companies such as Goldman Sachs disproportionately benefit from their close working relationship with the government. Here's how I transcribed Geithner's response:

I have a major problem in the acceptance of the "Too big to fail" bullshit.

What, exactly, does it mean to be too big to fail?

Does it mean that, if a business is big enough, no amount of corruption, no degree of incompetence, nothing can cause the business to fail? I don't think so. The financial services businesses that fed like pigs on the bailout money, obviously were failing.

Does it mean that when a company grows past a certain size, their failure would create havoc and destroy civilization as we know it? That implies both incomprehensible arrogance on the part of the corporations as well as incredible stupidity on the part of the people who buy into this crap. If All of the too big to fail companies shut down tomorrow, civilization would hit a blip, but within a short time period, hundreds, if not thousands of smaller businesses would fill in the void.

Perhaps "too big to fail" means that when an industry is large enough, it can wield political power of a magnitude that allows it to ignore the law with impunity. A republic (a government based on the rule of law) can only exist when the law applies equally to everyone.

Niklaus-

You're quite right on your analysis. In fact, community and smaller regional banks have been quite vocally upset with the whole bailout. They argue (correctly, I think) that it places them at a distinct competitive disadvantage.

You nailed it here:

Guys, I won't believe that the "crisis" is at all being addressed until someone, anyone from one of these banks or non-bank banks goes to jail!

We've had a supposed $7-14 TRILLION loss in liquidity due to financial shenanigans and no one has gone to jail from any bank, non-bank, mortgage company, AIG, or any of these stealers of dreams.

Obama has no credibility with me on financial reform unitil someone goes to jail!