About Your Tax Dollars Supporting the U.S. Proxy War Effort in Ukraine

The United States has already sent $68 Billion to toward the war effort in Ukraine a territorial dispute regarding who rules the Donbas Region of a country most Americans cannot locate on a map, a dispute that is risking "Armageddon," according to President Biden. The White House has now asked for another $37.7 Billion, so the total will soon be $105 Billion.

What does that mean for you if you are one of the 70 million Americans who pays taxes? It means that, on average, $1,500 of your taxes will go to U.S. involvement in Ukraine this year. Can you possibly think of any better use for your tax dollars?

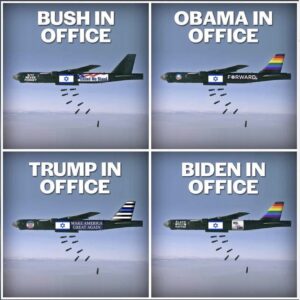

The following tweet about sums things up, complete with the regurgitated U.S. Iraq war trope about not having to fight "them" over here. Who is "they"? Russia, of course. Icing on the cake is Adam Schiff's admission that this is a U.S. proxy war against Russia: